Budget 2024 To The Point: This time, nothing has been cheap or expensive in the budget. Why so?

This is because, after the GST was implemented in 2017, only customs duty and excise duty were increased or decreased in the budget, which affects only a few things.

So this time, the government has not changed customs or excise duties. In such a situation, here we are talking about how much the prices of everyday essential items have increased or decreased in the last year.

There is the list of average domestic things prices list which increased & decreased in the upcoming budget-

- Toor dal increased from Rs 110 to Rs 154 per kg

- The price of rice has increased from ₹37 to ₹43 per kg.

- The price of Wheat has increased from ₹36.69 to ₹36.81 Kg

- Soyabean oil price has decreased from ₹149 to ₹121

- Milk price has increased for ₹54.96 to ₹58.06 per litre

- Sugar price has increased from ₹41.45 to ₹44.66

- Onion & Tomato Prices Have increased from ₹10

- Domestic Gas Cylinder price has decreased from ₹150

- Petrol & Diesel Price same as previous, there govt. Don’t make any changes

- Gold price has increased from ₹8,379 per 10 Gram & Silver Price Increased from ₹5,303 per KG

- SBI Home Loan Interest rate is increased from 0.25%

Products Become Cheaper And More Expensive Due To Increased Or Decreased Indirect Tax

One must first understand the taxation system to understand whether a product is cheap or expensive in the budget. Taxation is broadly divided into direct tax and indirect tax:

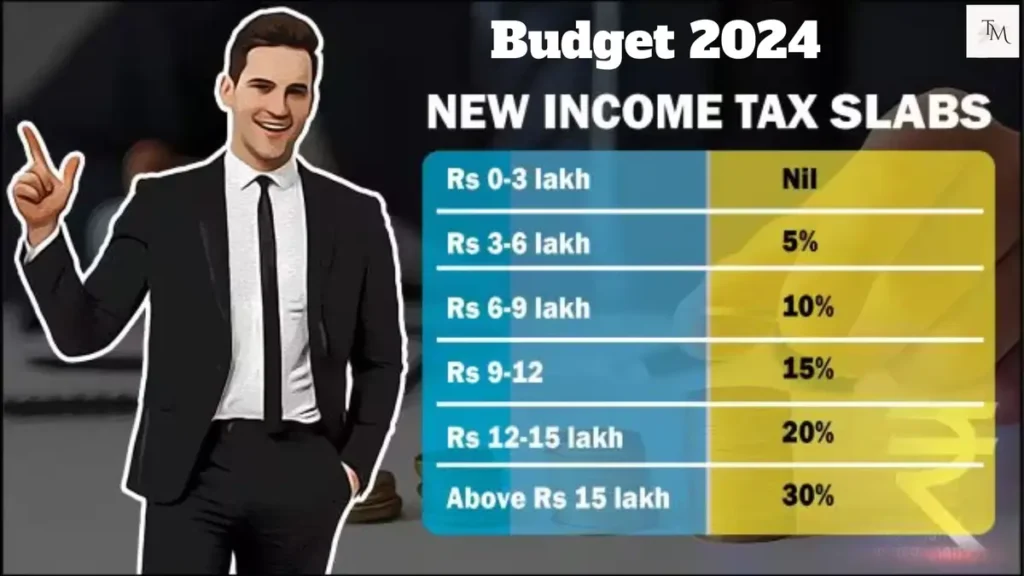

1. Direct tax: It is imposed on the income or profits of the people. Taxes like income tax and personal property tax come under this.

The burden of direct tax is borne by the person on whom the tax is imposed and cannot be passed on to anyone else. The Central Board of Direct Taxes (CBDT) governs it.

2. Indirect Tax: It is imposed on goods and services. Taxes like customs duty, excise duty, GST, VAT, and service tax are included in this. Indirect tax can be shifted from one person to another.

As the wholesaler passes it on to the retailers, who pass it on to the customers, its impact ultimately falls on them only. This tax is governed by the Central Board of Indirect Taxes and Customs (CBIC).

90% Of Products Under GST

Now, very few products are cheap or expensive in the budget. This is because, after 2017, almost 90% of the price of the products depends on GST. The GST Council takes all decisions related to GST.

Therefore, there is no change in the budget for the prices of these products. Whether the remaining products become cheaper or more expensive in the budget depends on increasing or decreasing indirect taxes like customs and excise duty.

What Did The Farmers Get In Budget 2024-25

Before contesting the Lok Sabha elections, the Modi government made no special announcements for the farmers in the interim budget. Finance Minister Nirmala Sitharaman said that Nano D.A.P. on crops. It will be used.

Apart from this, good work will be done in the field of dairy development, and milk farmers will be promoted. A new scheme of bio-manufacturing and bio-foundry will be started to promote green development.

The Scope Of MSP Has Not Increased, And The Amount Of Kisan Samman Nidhi Has Also Not Changed

The government has not increased the scope of Minimum Support Price (MSP). Apart from this, the amount of Kisan Samman Nidhi has not increased; it will remain only Rs 6,000.

In the budget, the amount of Prime Minister Kisan Samman Nidhi for female farmers was expected to be doubled, i.e., from Rs 6000 to Rs 12000 annually, but no change has been made.

Agricultural Budget Increased By Rs 2,000 Crore For The Financial Year 2024-25

The government has given Rs 1.27 lakh crore to the agriculture sector for the financial year 2024-25.

This has increased by only 2%, i.e. Rs 2,000 crore, compared to last year. Last year, the government gave Rs 1.25 lakh crore to the agriculture budget.

11.8 Crore Farmers Got Benefit Of PM Kisan Samman Nidhi Yojana

The government currently gives Rs 6,000 to farmers every year in 3 instalments of Rs 2,000 each. Under this scheme, the government has sent more than Rs 2.8 lakh crore to farmers’ accounts in 15 instalments.

Nirmala Sitharaman said that till now, 11.8 crore farmers have benefited from PM Kisan Samman Nidhi Yojana. More than 4 crore farmers have benefited from the crop insurance scheme.

Apart from this, 55 lakh new jobs have been created through Matsya Sampada Yojana. Under the National Agriculture Market, i.e., eNAM, 1,361 mandis were integrated. Due to this, the supporting trading volume has become ₹3 lakh crore.

SEE MORE: Budget 2024 Highlights: See Here Government New Budget For FY25

1 thought on “Budget 2024 To The Point: What Became Expensive & What Became Cheap, See Here Full List”